The Social Effect of Credit Cards and Mobile Payments

Credit cards are a part of our daily life. We use them to pay dinners in restaurants, buy medical prescriptions and purchase the latest must-have gadget. A few months ago I started to think about the behavior behind different segments of credit cards (i.e. Gold, Platinum) and the motivations behind the users.

I distinctly remember a few years ago going to dinner with some friends. At the end of the meal when we had to divide up the bill, my friend took out his brand new credit card. Someone commented in amazement, “Dude, you have a Platinum Card! That’s awesome!" The smile that grew on my friends face based on that comment was incredible.I have seen the same situation mulitple times when an "elite” credit card is used to make a payment. In addition to this reaction based on a status card, young adults also hold value based on the rewards system (i.e. Airline Points, % of Money Back).

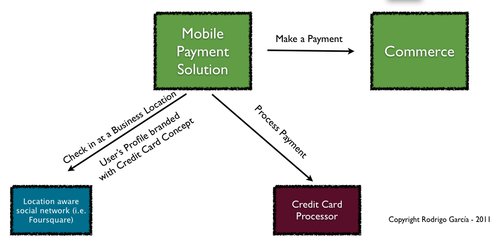

My point about this “social effect” is that while we arecurrently in an exciting time with the development of mobile paymentsolutions, the effect of its physical ancestors shouldn’t be forgetten: The prestige that a certain type of a credit card gives its holder. This effect can be rebuiltby mixing credit cards processors with social networks, like Foursquare where the partnership with the commerce can present unpredictable connections and drivers with customers. A potential use case could be a mobile payment solution that includes the ability to publish location and product purchases in a specified social network (at the descretion of the customer) with credit card branding. This can be illustrated in the diagram below:

Another point in the development of mobile payment solutions is related to the marketing of branded credit cards. While there is no physcial component in the transaction (sans credit card) the process is focused on the the interaction between a POS and a mobile phone.This will require the design of new strategies to push the visibility of the credit card brand.

In closing, I have to pause and wonder how the two largest international credit cards issuers (Mastercard and Visa) will reposition their efforts to in regards to mobile banking.